Hankotrade Review 2025

Hankotrade is an online forex and CFD broker that blends tight spreads, high leverage, and a social trading twist to attract both newbies and seasoned traders. Launched in recent years and registered in Saint Vincent and the Grenadines, it promises fast execution and low entry costs. But with its offshore roots and a mixed reputation, is Hankotrade a smart pick for 2025? This review breaks down its platforms, accounts, and reliability.

Headquarters: The Financial Services Centre, Stoney Ground, Kingstown, Saint Vincent and the Grenadines

Email: support@hankotrade.com

Phone: Not publicly listed (contact via site)

Website: https://hankotrade.com/

Note: This Hankotrade review is for informational purposes only and not financial advice.

Is Hankotrade a Reliable Choice?

Safety hinges on regulation, and Hankotrade operates under Saint Vincent and the Grenadines’ lax framework—no forex-specific oversight here. Unlike brokers under the FCA (UK) or ASIC (Australia), it lacks strict client fund protections, a concern for risk-averse traders in 2025. The site touts transparency and fast payouts, but without top-tier licensing or clear segregated account info, trust takes a hit.

To gauge its legitimacy:

- Contact support for regulatory details—SVG’s Financial Services Authority doesn’t regulate forex brokers.

- Scan X or trading forums for user feedback; some rave about quick withdrawals, others flag delays or lost profits.

- Check site security (HTTPS is standard, but payment specifics are vague).

With an offshore base and no robust regulatory backbone, Hankotrade carries risk. A demo account—if offered—lets you test it safely.

What Can You Trade?

Hankotrade delivers a decent lineup:

- Forex: 50+ currency pairs, covering majors and some exotics.

- Commodities: Gold, oil, and silver CFDs.

- Indices: Key global indices.

- Cryptocurrencies: Bitcoin, Ethereum, and more.

Leverage reaches 1:500 (sometimes advertised as 1:2000), with spreads starting at 0.7 pips on STP accounts and 0.0 pips on ECN tiers. Exact asset counts aren’t heavily detailed—expect clarity post-signup.

Hankotrade Trading Platform

Hankotrade runs on MetaTrader 4 (MT4) and MetaTrader 5 (MT5), with a nod to social trading:

- MT4/MT5:

- Tools: Advanced charting, 80+ indicators, and EA support for automation.

- Best For: Traders who value flexibility and analytics.

- Social Edge: Copy trades from top performers, a perk for beginners leaning on community strategies.

Available on desktop, web, and mobile, MT4/MT5 ensures fast STP/ECN execution—though liquidity providers aren’t specified. A demo mode is available for risk-free practice.

Hankotrade Account Types

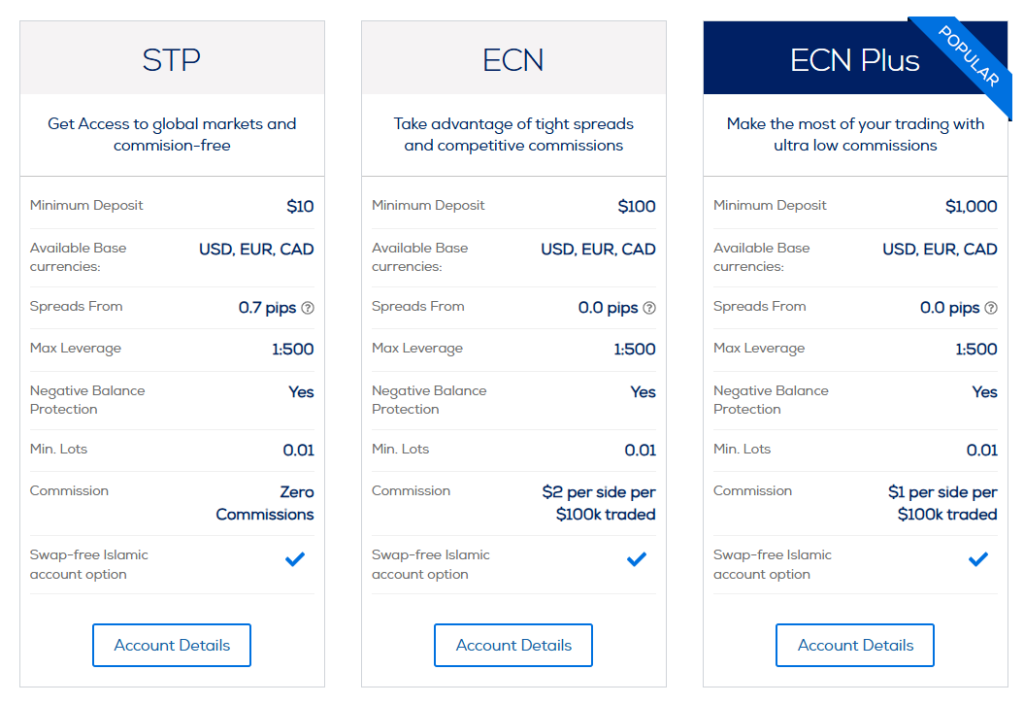

Hankotrade offers three core accounts:

- STP: Basic tier with 0.7-pip spreads, no commission.

- ECN: Tighter spreads (0.0 pips), $2 commission per $100k traded.

- ECN Plus: Enhanced conditions for high rollers.

The minimum deposit is just $10, with leverage up to 1:500. Islamic accounts are offered, but bonus details are sparse—reach out to support for the latest.

Hankotrade occasionally rolls out deposit bonuses, though specifics vary. Past offers include extra trading credit (e.g., 100% on deposits), often with volume-based withdrawal conditions. Check their site or support for current promotions, as these can shift.

Support Availability

Reach Hankotrade via email (support@hankotrade.com) or their site’s contact form—no phone number is widely listed. X users praise agents like Mike and Nathan for quick replies, but some report withdrawal hiccups. No live chat is a downside for urgent issues—test their responsiveness yourself.

Hankotrade: Hits and Misses

| Hits | Misses |

|---|---|

| $10 entry with 1:500 leverage. | Offshore SVG base, no forex regulation. |

| Tight spreads (0.0 pips on ECN). | Mixed reviews on withdrawals. |

| MT4/MT5 with social trading. | Limited transparency on fees/assets. |

Hankotrade shines with low costs, high leverage, and a solid MT4/MT5 setup, plus a social trading hook for newbies. Yet, its unregulated status and spotty payout reputation cast shadows in 2025. Verify claims, start with a demo, and keep stakes small—or choose a regulated broker for peace of mind.