Brisk Markets Review 2025

Brisk Markets is an online forex broker offering trading in forex, stocks, commodities, indices, and cryptocurrencies via a social trading twist. Launched in 2022 and registered in Saint Vincent and the Grenadines, it aims to blend intuitive tools with community-driven strategies, appealing to both newbies and seasoned traders. But with offshore roots and mixed user buzz, is Brisk Markets worth your time in 2025? This review dives into its platforms, account options, and trustworthiness.

Headquarters: The Financial Services Centre, Stoney Ground, Kingstown, Saint Vincent and the Grenadines

Email: support@briskmarkets.com

Phone: +1 (845) 393-0286

Website: https://www.briskmarkets.com/

Note: This Brisk Markets review is for informational purposes only and not financial advice.

Is Brisk Markets a Reliable Choice?

Safety starts with regulation, and Brisk Markets operates under Saint Vincent and the Grenadines’ loose oversight—no forex-specific licensing here. Unlike brokers regulated by the FCA (UK) or CySEC (Cyprus), it lacks strict fund protection rules, a red flag for cautious traders in 2025. The site claims reliability and transparency, but without a top-tier license or clear segregated account details, skepticism is warranted.

To assess its legitimacy:

- Reach out to support for regulatory clarity—SVG’s Financial Services Authority doesn’t oversee forex brokers.

- Check X or forums for withdrawal experiences; some praise fast payouts, others cry scam.

- Confirm site security (HTTPS is standard, but payment safety isn’t detailed).

With an offshore base and no robust regulatory shield, Brisk Markets leans risky. A demo account—if available—could ease you in without commitment.

What Can You Trade?

Brisk Markets offers a solid mix:

- Forex: 50+ currency pairs, likely majors and minors.

- Stocks: CFDs on global equities.

- Commodities: Gold, oil, and silver.

- Indices: Major market indices.

- Cryptocurrencies: Bitcoin and beyond.

Leverage hits 1:500, and spreads vary by account—down to 0.4 pips on elite tiers. The site promises 1,000+ CFDs, but specifics require digging post-signup.

Brisk Markets Trading Platform

Brisk Markets runs on MetaTrader 5 (MT5), a powerhouse platform, and adds a social trading layer:

- MetaTrader 5 (MT5):

- Tools: Deep charting, 80+ indicators, EA support for bots.

- Best For: Traders craving analytics and automation.

- Social Twist: Copy trades from top performers, leveraging community insights.

MT5 spans desktop, web, and mobile, with Brisk’s social feature letting you follow successful traders—a boon for beginners. Execution is billed as fast via STP/ECN, though liquidity sources aren’t named. A demo option exists for practice runs.

Brisk Markets Account Types

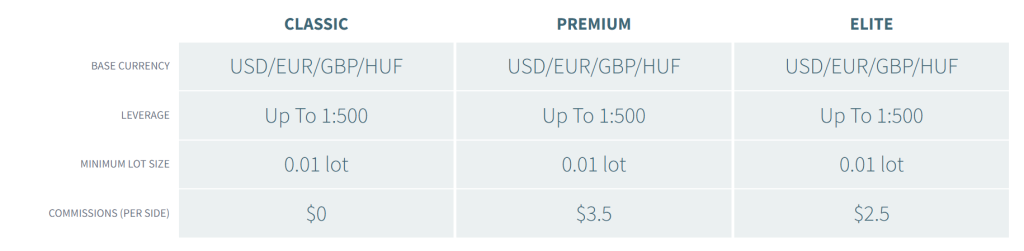

Brisk Markets offers three main accounts:

- Classic

- Premium

- Brisk Elite

The site lists a $250 minimum deposit for the Classic tier, with leverage up to 1:500 and spreads tightening on higher tiers (0.4 pips for Elite). Islamic accounts and a 30% deposit bonus (up to $2,000) are also in play—details need support confirmation.

Bonus Incentives

A 30% deposit bonus spices up funding—deposit $1,000, get $300 extra, capped at $2,000. It’s instant but tied to terms; withdrawals may require volume targets. Promotions can shift, so check their site for the latest.

Support Availability

Contact Brisk via email (support@briskmarkets.com) or phone (+1 (845) 393-0286). Users on X laud quick responses, but some grumble about withdrawal snags. No live chat is a gap for urgent needs—test support yourself to judge.

Brisk Markets: Hits and Misses

| Hits | Misses |

| $250 entry with 1:500 leverage. MT5 with social trading for easy starts. 1,000+ CFDs across markets. | Offshore SVG base with no forex regulation. Withdrawal complaints cloud trust. Limited platform variety (MT5 only). |

Brisk Markets pairs a robust MT5 platform and social trading with a low entry bar, tempting for cost-conscious or copy-trading fans. Yet, its unregulated SVG status and spotty payout reputation make it a dicey pick for 2025. Verify claims, test with a demo, and keep stakes low—or opt for a regulated rival for surer footing.